Audit? Tax? Advisory? How to choose a specialism in practice

Those who train in a smaller accountancy practice will typically have broad exposure to many areas including accounts preparation, VAT returns and payroll.

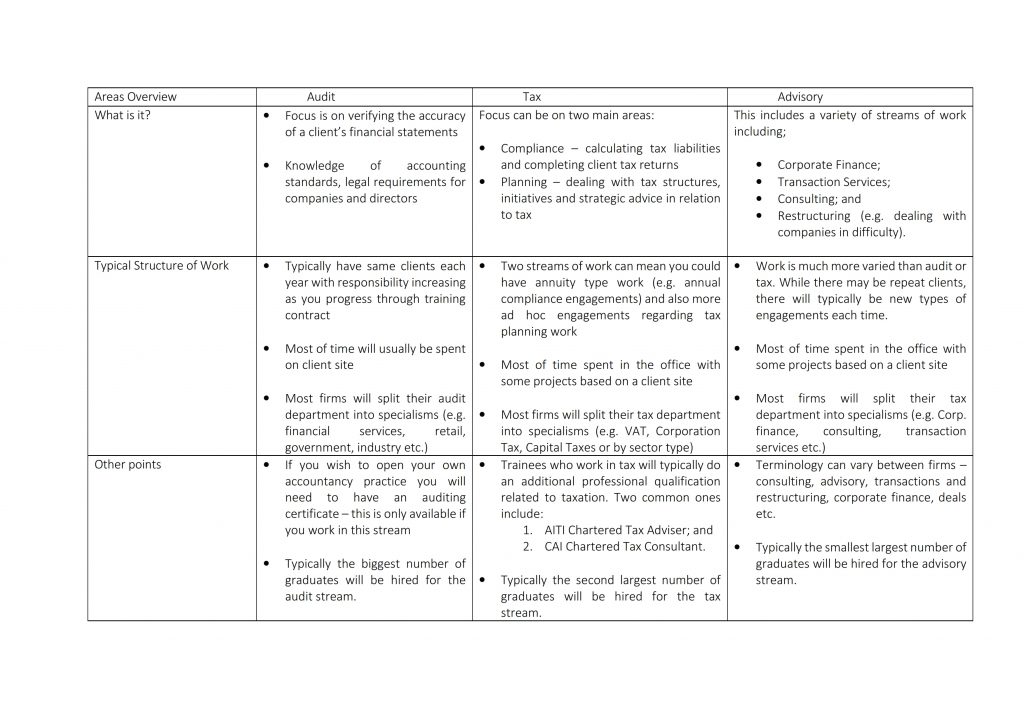

In the majority of larger accountancy practices, however, trainee accountants will specialise in a particular stream during their training contract. Although the titles given to particular departments may differ, larger firms typically work in three main areas – audit, tax and advisory.

Audit usually has the largest headcount, then tax and finally advisory. It’s important to do your research and understand what kind of work is involved in each area – internships, work placements and insight days are a great way to get first-hand experience of a certain practice area. They also give you a chance to talk to people already working in a particular specialism.

Cruncher has done a bit of the leg work for you, of course. Below, we discuss some key factors to consider when deciding on what area you would like to train in. We also provide a summary of audit, tax and advisory.

Key factors to consider when choosing a specialism

When considering which practice area to apply for, reflect on the following points:

- What subjects did you prefer in college? Would you be interested in working in tax, finance or audit/accounting on a day-to-day basis?;

- What are your long-term ambitions? Do you wish to open your own practice or work in an accounting function at a large company, for example?;

- Get the inside track from people who work in these different areas. Attend firm talks, ask questions and meet people working in different areas; and

- Consider the number of available roles in each area. This shouldn’t be a deciding factor, but it will at least make you aware of the likely level of competition.

Specialism overview and key points

There’s one more thing you need to know – it’s not just the specialism, but the clients you will service in that specialism that will make a difference to your long-term career.

Put simply, if you audit large multinational companies you will be most likely to get a job in one of those companies when you qualify. If you audit funds clients, on the other hand, you will be most likely to get a job in a funds company after you qualify. And if you audit food companies you will… you get the idea.

Many graduates overlook this key point. You might get a chance to choose what client type you work with, but a lot of firms will allocate you randomly if you don’t express a preference. If you do have a preference, make sure you let your superiors know or they’ll decide for you!